![]()

Malaysia’s Rise as a Data Center Powerhouse

Since ChatGPT took the world by storm, interest in and discussions about artificial intelligence have soared. Numerous companies have been investing heavily in this field and expanding overseas, making Malaysia a popular destination for data center construction.

On one hand, the surging demand for robust data infrastructure, driven by digital transformation, increased internet access, and widespread smartphone adoption, has been further amplified by the push for remote services and cloud computing. On the other hand, Malaysia’s strategic positioning as a data center destination, benefiting from Singapore’s development constraints, has enhanced its prominence in the region’s digital landscape, driving data center expansion and fueling its growing digital economy. This article will delve into this trend by examining Malaysia’s digital economy development, the reasons behind its emergence, and the outlook for its future development.

Malaysia's Digital Economy Development

According to DC Byte’s “Global Data Center Index 2024,” Johor Bahru is the fastest-growing data center market in Southeast Asia. This market has attracted billions of dollars in data center investments from tech giants such as Google, Nvidia, and Microsoft. James Murphy, DC Byte’s Asia Pacific general manager, noted that Johor Bahru is poised to surpass Singapore in the coming years to become Southeast Asia’s largest data center market.

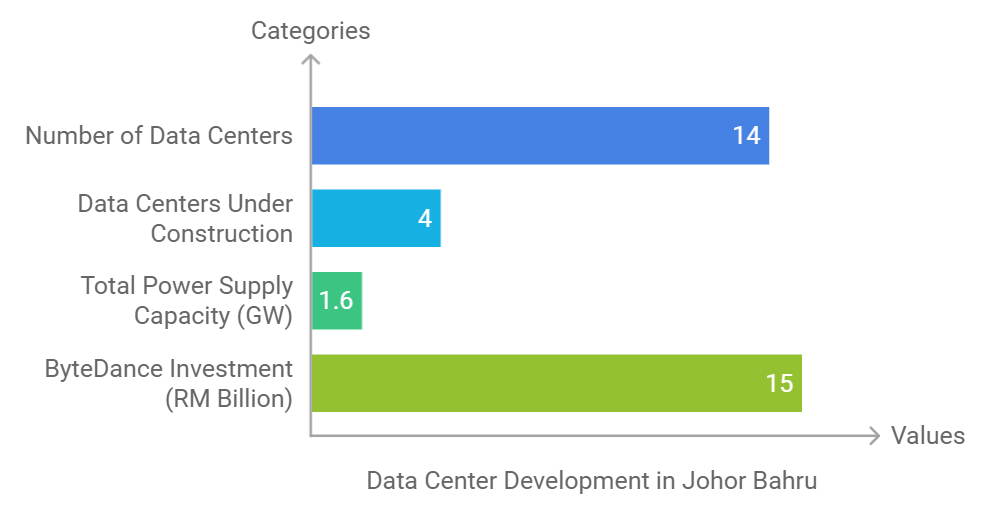

Johor’s proximity to Singapore is a geographical advantage that has attracted many multinational companies headquartered in Singapore. These companies have been choosing to build data centers in Johor to take advantage of the region’s cheaper land, construction costs, and operational expenses, particularly electricity. For example, Yondr Group, a Dutch company with an Asia Pacific office in Singapore, has launched a 300MW data center park in Johor. First Data research found that the development of data centers in Johor is primarily concentrated in three technology parks. Johor has 14 data centers, with another four under construction.

Recently, Chinese parent company ByteDance announced plans to invest approximately RM10 billion (US$2.13 billion) to establish an artificial intelligence center in Malaysia. As part of the deal, ByteDance will also invest an additional RM15 billion to expand its data center facilities in Johor, Malaysia. This move is of significant importance to Malaysia’s economic development.

The report states that the total supply of data centers in Johor Bahru, a small city on the Singapore border, is 1.6 gigawatts, including projects under construction, committed, or in the early stages of planning. Data center capacity is typically measured by the amount of electricity it consumes. If all planned capacity comes online in Asia, Malaysia will only be surpassed by larger countries like Japan and India. Previously, Japan and Singapore have led the region in terms of real-time data center capacity. The index did not provide a detailed breakdown of China’s data center capacity.

Reasons for Malaysia's Emergence

Geographical Advantage

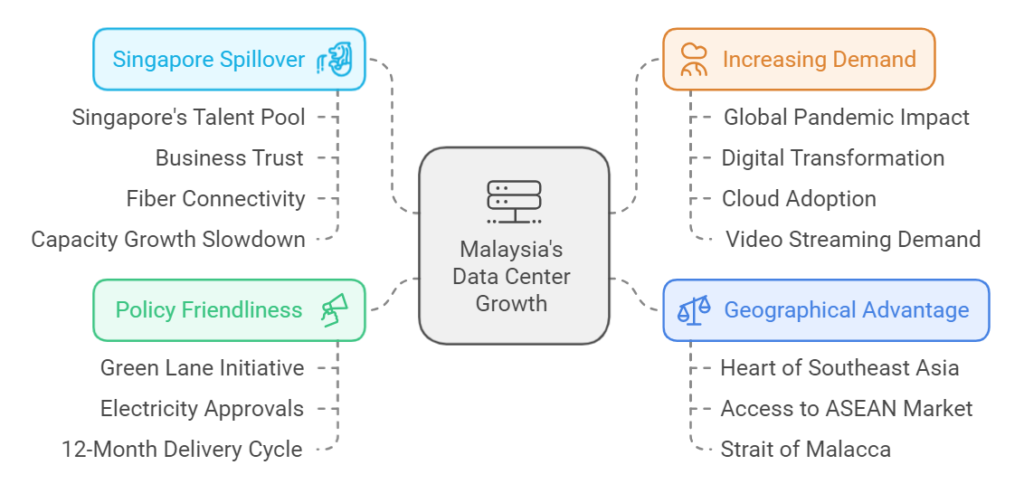

Malaysia is located at the heart of Southeast Asia, connecting Maritime Southeast Asia and Mainland Southeast Asia, and guards the Strait of Malacca. It is a hub for accessing the ASEAN market and reaching the Middle East and Australasia, with a superior geographical location.

Policy Friendliness

While many AI data centers will be built in mature markets like Japan, Murphy said emerging markets are also attracting investment due to their favorable conditions. Data center-friendly policies have also made Malaysia an attractive market. Authorities launched the “Green Lane” initiative in 2023 to simplify electricity approvals, reducing the data center delivery cycle to 12 months.

Singapore Spillover

However, another major catalyst in recent years has been Singapore’s cross-border policies. Although Singapore’s talent pool, business trust, and fiber connectivity make it an attractive area for data centers, the government began to slow down the growth of data center capacity in 2019 due to the scale of its energy and water consumption.

Increasing Demand

The vast majority of data center infrastructure and storage investments have traditionally flowed to mature markets such as Japan, Singapore, and Hong Kong. However, according to a report by global data center provider EdgeConneX, the global pandemic accelerated the world’s digital transformation and cloud adoption, leading to a surge in demand for cloud providers in emerging markets such as Malaysia and India. Murphy said, “The increased demand for video streaming, data storage, and anything done over the internet or mobile phone essentially means that demand for data centers will increase.”

Concerns About Future Development Trends

Malaysia is rapidly emerging as a data center powerhouse in Southeast Asia and the entire Asian region. Johor Bahru is poised to surpass Singapore in the coming years to become Southeast Asia’s largest data center market. The construction of data centers by major manufacturers will not only provide local businesses with more powerful cloud computing capabilities, forming corresponding industrial clusters, but will also promote Malaysia’s position in the global digital economy. As projects progress, future updates on construction progress and industrial development will continue to be closely watched.

With the influx of tech giants, it is believed that Malaysia will become an important center for the global artificial intelligence and high-tech industry, further helping to boost Malaysia’s economy. However, this has also raised concerns about the demand for energy and water.

Kenanga Investment Bank Research estimates that by 2035, the potential electricity demand for data centers in Malaysia will reach a maximum total demand of 5 gigawatts (GW). According to Tenaga Nasional Berhad, Malaysia’s national power company, the total installed capacity of the entire Malaysia is currently about 27 gigawatts (GW).

A recent report in The Straits Times quoted local officials as saying they were increasingly concerned about the level of electricity consumption. Mohd Noorazam Osman, mayor of Johor Bahru City Council, said that data center investments should not compromise the needs of local resources, especially as the city faces challenges in water and electricity supply. At the same time, the Johor state government will also be introducing more guidelines on the use of green energy for data centers in June.

[Image source: Image by svstudioart]

How much housing loan you can get?

How much is your property worth?

Interested in new launch property?

Looking for property for sale or rent?

Subscribe to our email newsletter today to receive updates on the latest news, property guides, new launches, featured secondary market properties and special offers.

Reese Tan

Reese, a former traditional media writer, is now a Content Writer at Hartamas. She focuses on creating content to empower property seekers in their home-buying journey.